SOCI209 - Module 2 - INFERENCE IN SIMPLE LINEAR REGRESSION

1. Inference in Regression Models

From Module 1 the parameters b1 and

b0 are estimated as

b1 = (S(Xi

-

X.)(Yi - Y.))/S(Xi

-

X.)2

b0 = Y.-

b1X.

Just like other statistics (such as the sample mean or variance) the estimates

b1 and b0 are functions of the observed values Yi,

which are functions of the random errors ei.

Thus b1 and b0 are themselves random variables and

b1 and b0 each has a probability distribution, called

the sampling distribution. The sampling distribution of b1

(respectively b0) refers to "the different values of b1

(b0) that would be obtained with repeated sampling when the

levels of the independent variables X are held constant from sample to

sample" (ALSM5e p. 41; ALSM4e p. 45). Statistical inference

concerning populations parameters such as b1

and b0 consists in testing hypotheses

and constructing confidence intervals for that parameter. Inference

concerning a parameter is based on the sampling distribution of that parameter.

For (simple or multiple) linear regression models statistical inference

is commonly carried out for

-

the regression coefficients b1

and b0 (hypothesis tests and confidence

intervals)

-

the mean response E{Yh} knowing Xh (whether Xh

corresponds or not to an observation in the sample) (confidence intervals

only)

-

the individual value of a "new" observation Yh(new) knowing

Xh (whether Xh corresponds or not to an observation

in the sample) (confidence intervals only)

-

F test of the significance of the regression model as a whole (test only)

2. Inference on b1 and

b0

1. Sampling Distribution of b1

The informal derivation below shows that if the errors ei

are normally distributed the sampling distribution of t*=(b1-

b1)/s{b1} is a Student

t distribution with (n-2) degrees of freedom (df). t* refers to the

deviation (b1- b1) of

b1 from its expectation (b1)

divided by the estimated standard error s{b1} of b1

(i.e., the estimated standard deviation of the sampling distribution of

b1). The standard error s{b1} is estimated

from the data as s{b1}=[MSE/S(Xi

- X.)2 ]1/2. Thus t is the standardized

value of b1 (i.e., a z-score). When the distribution of

errors is not too far from normal and the sample is not too small the distribution

of t

approximately follows a Student t distribution. Even

when the distribution of errors is far from normal, the distribution of

t* approaches a Student t distribution (actually a normal distribution)

as the sample size n becomes large.

Informal derivation of the sampling distribution of t*

|

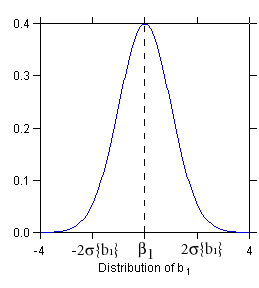

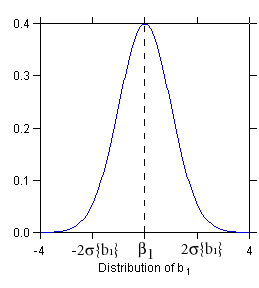

STEP 1: Sampling Distribution of b1

Assuming that errors are normally distributed

b1 ~ N ( b1

, s2{b1})

(~ means is distributed as)

where s2

denotes the variance of ei and s2{b1}

= s2

/ S(Xi - X.)2.

In words: b1 is normally distributed with mean E{b1}

= b1 and variance s2{b1}

= s2

/ S(Xi - X.)2

(figure at left).

The sampling distribution of b1 is normal because b1

is a linear combination of the observations Yi which are independent

normally distributed random variables (ALSM5e, ALSM5e: Appendix A, Theorem

A.40). Note the denominator S(Xi

- X.)2 in the expression for s2{b1}:

the greater the variance of X, the smaller the variance

s2{b1}

of the sampling distribution, and the more precise the estimation of b1.

(In experimental research, where the experimenter sets the values of X,

one may be able to space the X values optimally to achieve the smallest

s2{b1}

possible.) |

Distribution of (b1-b1)/

s{b1}

Distribution of (b1-b1)/

s{b1}

|

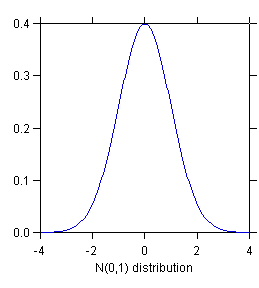

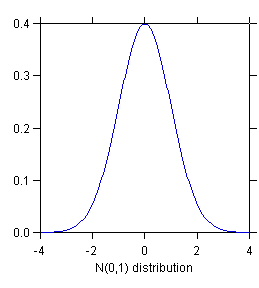

STEP 2: Distribution of (b1-b1)/s{b1}

(b1-b1)/s{b1}

~ N (0, 1)

In words: the deviation of b1 from its mean b1

, divided by the standard error

s{b1},

is normally distributed with mean 0 and standard deviation 1 (i.e., according

to a standard normal distribution). This follows from STEP 1 by applying

to b1 by the equivalent of the z transformation z = (X - m)/s.

s{b1} denotes the standard deviation

of the sampling distribution of b1. s{b1}

is called the standard error of b1. |

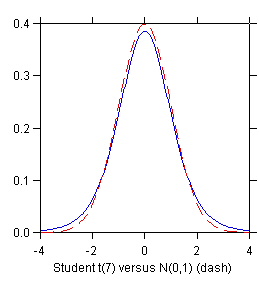

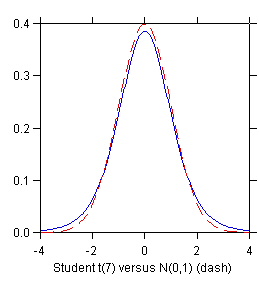

Distribution of t* = (b1- b1)/

s{b1} (solid

Distribution of t* = (b1- b1)/

s{b1} (solid

blue line) compared to distribution of

(b1- b1)/

s{b1}

(red dashed line)

|

STEP 3: Distribution of (b1 - b1)/

s{b1}

In practice

s{b1} is not known (because

s is not known) so one replaces the standard

error

s{b1} with the sample estimate

s{b1} given by

s{b1} = [MSE / S(Xi

- X.)2]1/2

where MSE is the mean squares error. When s{b1}

is replaced by the sample estimate s{b1}, the sampling distribution

is no longer normal. It becomes a Student t distribution with (n-2)

df:

t* = (b1- b1)/

s{b1} ~ t (n - 2)

The distribution is no longer normal because s{b1} (being a

sample estimate) is a random variable rather than a fixed constant. This

"extra randomness" produces the thicker tails of the t distribution

compared to the normal. The (n - 2) df correspond to the (n - 2)

df of MSE (see Module 1).

|

The derivation of the sampling distribution of b0 is shown later.

Inference on the regression coefficients uses the following formulas.

Table 1. Formulas for Inference on b1 and

b0

| Slope b1 |

|

| Estimated standard error of b1 |

s{b1} = (MSE/S(Xi

- X.)2)1/2 |

| Estimated sampling distribution of b1 |

(b1 - b1)/s{b1}

~ t(n - 2) |

| Confidence limits for CI on b1 |

b1 +/- t(1 - a/2; n - 2)s{b1} |

| Test statistic for H0: b1

= b10 |

t* = (b1 - b10)/s{b1}

(1) |

| Intercept b0 |

|

| Estimated standard error of b0 |

s{b0} = (MSE(1/n+X.2/S(Xi

- X.)2)1/2 |

| Estimated sampling distribution of b0 |

(b0 - b0)/s{b0}

~ t(n - 2) |

| Confidence limits for b1 |

b0 +/- t(1 - a/2; n - 2)s{b0} |

| Test statistic for H0: b0

= b00 |

t* = (b0 - b00)/s{b0}

(1) |

Notes: (1)

-

b10 and b00

denote hypothetical values of the parameters

-

when b10 = 0 (the most

common type of hypothesis) then t* = b1/s{b1}

|

The estimated standard error s{b1} is typically provided

in the standard regression printout (labeled Std Error in Table 2).

Table 2 repeats the regression printout used for illustration.

Table 2. Printout of Regression of % Clerks on Seasonality

Index

Dep Var: CLERKS

N: 9 Multiple R: 0.852 Squared multiple R: 0.726

Adjusted squared multiple

R: 0.687 Standard error of estimate: 2.103

Effect

Coefficient Std Error Std Coef

Tolerance t P(2 Tail)

CONSTANT

14.631 1.700

0.000 .

8.607 0.000

SEASON

-0.169 0.039

-0.852 1.000 -4.311

0.004

Analysis of Variance

Source

Sum-of-Squares df Mean-Square

F-ratio P

Regression

82.199 1 82.199

18.583 0.004

Residual

30.963 7

4.423

2. Inference on b1

We look at inference on b1 first

because it is the most common.

Confidence Interval for b1

From Table 1 the confidence limits of the CI for b1

are

b1 +/- t(1 - a/2; n -

2)s{b1}

where t(1 - a/2; n - 2) refers to the (1 - a/2)100th

percentile of the Student t distribution with (n-2) df.

Example: find the 95% CI for b1,

the coefficient of seasonality in the simple regression of % clerks.

b1 = -.169 (from regression printout under Coefficient)

s{b1} = .039 (from regression printout under Std Error)

choose a = .05; then t(1-a/2;

n-2) = t(.975; 7) = 2.365 (from statistical program or from table)

Therefore the 95% CI for b1 is

L = -.169 - (2.365)(.039) = -0.261 (lower bound of CI)

U = -.169 + (2.365)(.039) = -0.077 (upper bound of CI)

One can say that with 95% confidence

-0.261 <= b1 <=

-0.077

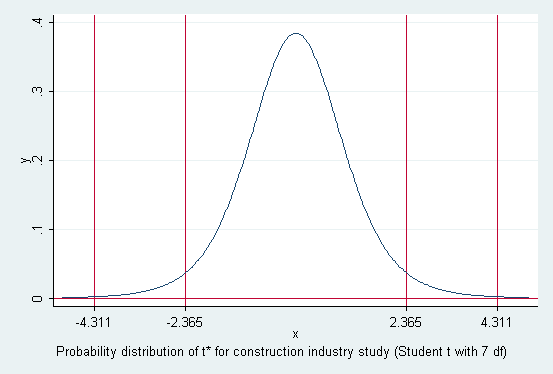

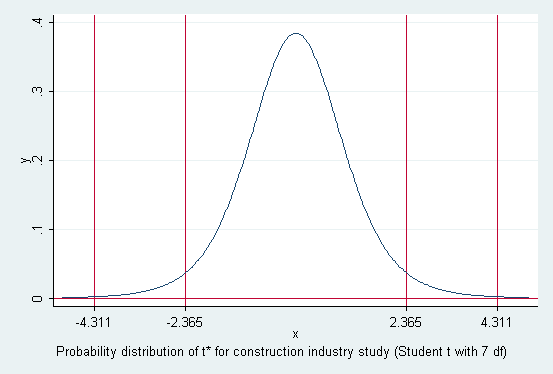

Two-sided test for b1

Example: Test the hypothesis that the coefficient of seasonality b1

= 0. The setup is

H0: b1 = 0

("null hypothesis")

H1: b1<>

0 ("research hypothesis")

The test statistic corresponding to H0: b1

= 0 is

t* = (b1 - 0)/s{b1} = b1/s{b1}

(provided in the regression printout under t).

Choose a significance level a = .05.

Using the P-value approach, the test statistic is

t* = (-.169)/(.039) = -4.311 (also from regression printout

under t)

Find the 2-tailed P-value

P{|t(n - 2)| > |t*| = 4.311 = .004 (from regression printout

under P(2 Tail)).

Since P-value = .004 < a = .05, one concludes

H1, that "there is a significant linear association between

% clerks and seasonality", or "the coefficient of seasonality is significant

at the .05 level". (One would actually say "at the .01 level" in

this case, choosing the lowest "round" significance level greater than

the P-value .004.)

Using the decision theory method the decision rule is

if |t*| <= t(1-a/2; n-2), conclude

H0

if |t*| > t(1-a/2; n-2), conclude H1

With a = .05, t(1-a/2;

n-2) is

t (0.975; 7) = 2.365

Since |t*| = 4.311 > 2.365 conclude H1 (b1<>

0) at the .05 level with this method also.

One-sided test for b1

Hint: It is often easier to write down H1 (the "research hypothesis")

first; then H0 is the complement of H1

In the regression of % clerks on seasonality the one-sided test is

lower-tailed, since b1 (-.169) is negative, so the hypothesis

setup is

To carry out the test

-

if b1 is in a direction opposite to H1 (i.e., if

b1 > 0), then there is no point in doing the test

and H1 can be rejected at the outset

-

otherwise (b1 is in a direction compatible with H1)

using the P-value approach one simply calculates the 1-sided P-value associated

with b1 by dividing the 2-tailed P-value (shown on the regression

printout) by 2

In the example the 2-sided P-value is .004; thus the 1-sided P-value is

P(t(n - 2) < t*) = (.004)/2 = .002

Since P-value = .002 < .05 = a, conclude

H1: b1

< 0.

Using the decision theory method the decision rule is

if |t*| <= t(1-a; n-2), conclude

H0

if |t*| > t(1-a; n-2), conclude H1

In the example

t(1-a; n-2) = t(0.95; 7) = 1.895

Since |-4.311| > 1.895, conclude H1: b1

<

0 by this method also.

Comparing Two-sided and One-sided Tests for b1

Comparing the two types of tests it appears that the 1-sided test is

"easier" (i.e., more likely to turn up significant) than the corresponding

2-sided test. (For example, the P-value of the 1-sided test is

half the P-value of the 2-sided test.)

Thus there is an incentive to use 1-sided tests to increase the chance

of significant results. It is considered legitimate to use a 1-sided

test whenever one has a genuine directional hypothesis concerning b1.

In the construction industry study the author's expectation that greater

seasonality is associated with less bureaucracy (implying a negative slope)

is a genuine directional hypothesis. Thus a 1-sided test is appropriate

in this case. (In any case in this example the slope is significant

in the 2-sided test, too.) This opinion on the use of one-tailed

tests is widely shared by reviewers of professional journals. However,

some statisticians recommend using 2-sided tests exclusively, on the ground

that the 2-sided test is conservative.

3. Inference on b0

CIs and tests for b0 are carried

out in exactly the same way as for b1.

Q - Using information from the printout

-

calculate the 95% CI for b0

-

test the 2-sided hypothesis that b0

<> 0

4. (Optional) Sampling Distribution of b0

The intercept b0 is estimated as

b0 = Y. - b1X.

The estimated standard error of b0 is

s{b0} = (MSE(1/n+X.2/S(Xi

- X.)2)1/2

The standardized statistic

t* = (b0 - b0)/s{b0}

is distributed as t(n - 2)

(See ALSM5e pp. 48-49; ALSM4e pp. <>)

3. Inference for Mean Response E{Yh}

1. Sampling Distribution of ^Yh

The mean response E{Yh} is estimated as ^Yh

= b0 + b1Xh. Thus the variance of

the sampling distribution of ^Yh is affected by variance in

both b0 and b1 sampling and by how far Xh

is from the sample mean of X. The way in which the variance of ^Yh

depends on the distance of Xh from X. is shown in

the next exhibit: given a change in b1, the change in ^Yh

is larger further away from the mean.

Table 3. Formulas for Inference on ^Yh

| Point estimator of E{Yh} |

^Yh = b0 + b1Xh |

| Estimated standard error of ^Yh |

s{^Yh} = (MSE ((1/n) + (Xh - X.)2

/ S(Xi - X.)2))1/2 |

| Estimated distribution of ^Yh |

(^Yh - E{Yh}) / s{^Yh} ~ t (n-2) |

| Confidence limits for CI on E{Yh} |

^Yh +/- t(1- a/2; n-2)s{^Yh} |

| Test statistic |

Not often used |

Notes:

-

Xh is a given level of X which does not necessarily correspond

to a data point Xi

-

the standard error of ^Yh is affected by (Q - explain how)

-

MSE

-

(Xh - X.) the deviation of Xh from the

sample mean of Xi

-

variability of Xi

-

sample size n

|

2. CI for Mean Response E{Yh}

Example 1

Given the regression of % clerks on seasonality, calculate an interval

estimate for E{Yh} when seasonality is 35, i.e. Xh

= 35.

First calculate s{^Yh}.

From the regression printout in Table 2 n = 9 and MSE = 4.423.

One needs additional information not contained in the standard regression

output.

From Module 1, Table 1: X. = 39.556; S(Xi

- X.)2 = 2886.222.

For Xh = 35, ^Yh = 14.631 + (-0.169)(35) = 8.716

and (Xh - X.)2 = (35 - 39.556)2

= 20.757.

Thus s{^Yh} = (4.423((1/9) + 20.757/2886.222))1/2

= 0.7233628.

Choose a = .05, so that t(.975;7) = 2.365.

Then the confidence limits for E{Yh} are

L = 8.716 - (2.365)(0.7233628) = 7.005 (lower bound)

U = 8.716 + (2.365)(0.7233628) = 10.427 (upper bound)

so that with 95% confidence

7.005 <= E{Yh|Xh = 35} <= 10.427

Example 2

This example illustrates a technique to obtain s{^Yh} from the

computer rather than computing it "by hand".

The example uses the data set knnappenc07.syd (see KNN Appendix

C data set 07). Units are 522 home sales in a mid-western town.

Y is the sale price in dollars; X is the finished area of the home in square

feet. The county tax collector runs a simple regression of sale price

on finished area, obtaining

^Y = -81432.9464 + 158.9502X n=522 R2

= .6715

The tax collector wants to estimate of the average sale price (i.e.,

E{Yh}) of homes with 2,500 square feet of finished area and

obtain a 95% CI for that average sale price. To calculate both ^Yh

and s{^Yh} quickly, the tax collector adds a 523d "dummy" case

to the data set, with only the value of 2500 for X and missing value for

Y and re-runs the regression. Then he obtains ^Yh

and s{^Yh} for all observations, including the dummy one (STATA

predict yhat, xb; predict seyhat, <>; SYSTAT save resid

with variables ESTIMATE and SEPRED).

So for Xh=2500

^Yh = 315942.6306

s{^Yh} = 3654.4390

Thus using the formula above the 95% CI for the average sale price

of homes with 2,500 square feet of finished space is

L = 315942.6306 - (1.9645365)(3654.4390) = 308763.35

(lower bound)

U = 315942.6306 + (1.9645365)(3654.4390) = 323121.91 (upper bound)

Note that this is a relatively narrow interval, indicating that the average

sale price of 2500 square feet homes can be estimated quite precisely.

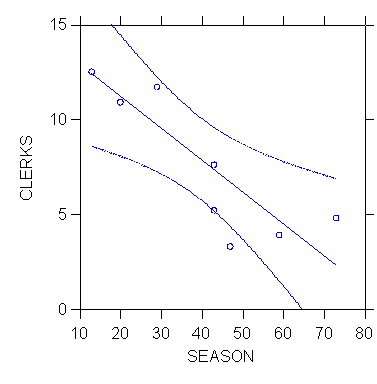

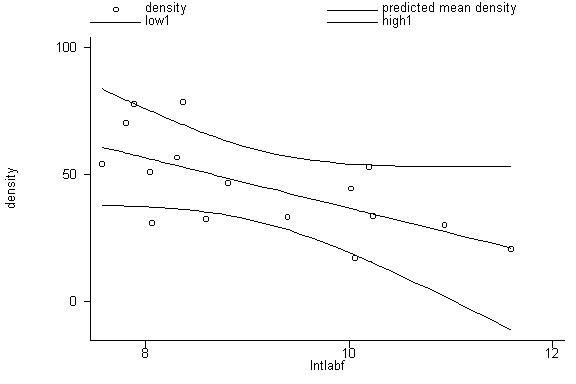

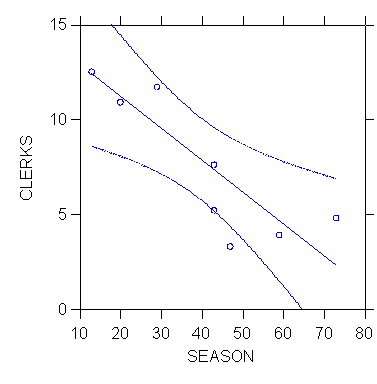

3. CI for the Entire Regression Line - the Working-Hotelling Confidence

Band

The Working-Hotelling confidence band is a CI for the entire regression

line E{Y} = b0+b1X.

The next exhibit shows the 95% Working-Hotelling confidence band for the

regression of % clerks on seasonality. The W-H confidence band is

often examined graphically.

The bounds of the (1-a) W-H confidence band

for Xh are given by

^Yh +/- Ws{^Yh}

where

W = [2F(1-?; 2, n-2)]1/2

(See ALSM5e pp. 61-63.)

4. (Optional) Derivation of Sampling Distribution of ^Yh

The standard error of ^Yh is estimated as

s{^Yh} = (MSE ((1/n) + (Xh - X.)2

/ S(Xi - X.)2))1/2

(^Yh - E{Yh})/s{^Yh} is distributed as

a t distribution with (n-2) df. (See ALSM5e pp. 52-54.)

4. Prediction Interval for a New Observation Yh(new)

1. Sampling Distribution of Yh(new)

Prediction intervals are especially important for quality control

(QC) in an industrial context. (The procedure is explained in detail

in ALSM5e pp. 55-61; ALSM4e pp. 61-66 pp. 61-66.)

Examples:

-

predict first-year college GPA of an individual student (not in the sample),

knowing his/her SAT and the regression of GPA on SAT

-

predict the sale price of an individual home that has 2500 square feet

of finished space, in a certain Midwestern town

In both cases one is trying to predict the value Yh(new) of

the response for an individual case with a specific value Xh

of the independent variable. This is different from the previous

situation where one wants to estimate the average value of Y for

X=Xh.

One estimates Yh(new) as ^Yh,= b0+b1Xh,

the value of ^Y on the regression line corresponding to Xh.

Variation in Yh(new) is affected by two sources:

-

variation in ^Yh, the estimated mean of the distribution of

Y given Xh, namely s2{^Yh}

-

variation in the probability distribution of Y around its mean given Xh,

namely s2

The decomposition of the variation in Yh(new) is shown in the

next two exhibits.

Therefore,

s2{Yh(new)}

= s2

+ s2{^Yh}

Thus the sampling disribution of Yh(new) is described as in

the following table.

Table 4. Formulas for Inference on Yh(new)

| Point estimator of Yh(new) |

^Yh = b0 + b1Xh |

| Estimated standard error s{Yh(new)} (s{pred}) |

s{pred} = (MSE (1 + (1/n) + (Xh - X.)2

/

S(Xi - X.)2

))1/2 |

| Estimated distribution of Yh(new) |

(Yh(new) - E{Yh}) / s{pred} ~ t (n-2) |

| Confidence limits for CI on Yh(new) |

^Yh +/- t(1- a/2; n-2)s{pred} |

| Test statistic |

Not often used |

2. CI for Yh(new)

This example uses again the SYSTAT data set knnappenc07.syd (see

KNN Appendix C data set 07). Units are 522 home sales in a mid-western

town. Y is the sale price in dollars; X is the finished area of the

home in square feet. The estimated regression is

^Y = -81432.9464 + 158.9502X n=522 R2

= .6715

Imagine this time that that someone plans to sell their home in this Midwestern

town. They ask a real-estate agent to estimate the price the home

might fetch on the market, given that it has 2500 square feet of finishes

space, and to give them a 95% CI for that price. The real estate

agent uses the same trick as the tax collector, of adding a "dummy" 523d

case with X = 2500 to obtain both ^Yh and s{^Yh};

she also obtains MSE from the regression printout, so she has the following

information

^Yh = 315942.6306

s{^Yh} = 3654.4390

MSE = 6.26043E+09

From this information she calculates s2{Yh(new)}

as

s2{Yh(new)}

= s2 + s2{^Yh}

= MSE + (SEPRED)2 = 6.26043E+09 + (3654.4390)2 =

6273784924.40

Hence s{Yh(new)} = (6273784924.40)1/2 = 79207.23.

Thus the 95% CI for the estimated sale price of an individual 2500

square feet home is obtained as

L = 315942.6306 - (1.9645365)(79207.23) = 160337.14 (lower

bound)

U = 315942.6306 + (1.9645365)(79207.23) = 471548.12 (upper bound)

Note that the 95% CI for Yh(new) (160K to 472K) is considerably

wider than the CI for the mean response E{Yh} (309K to 323K).

(Q - Why is that?)

3. (Optional) Derivation of Sampling Distribution of

Yh(new)

See ALSM5e pp. 55-60.

5. F Test for Entire Regression (Alternative Test of b1

= 0)

1. F Test of b1 = 0

Here this test is overkill, since the t test can be used to test the hypothesis

that b1 = 0.

But the F test generalizes to multiple regression to test the hypothesis

that all the regression coefficients are zero.

2. Expected Mean Squares

One can show that

E{MSE} = s2

E{MSR} = s2

+ b12 S(Xi

- X.)2

(ALSM5e pp. 68-71; ALSM4e pp. 75-76)

Note that if b1=0, E{MSR}

= E{MSE} = s2.

Therefore, an alternative to the 2-sided hypothesis test for b1

H0: b1 = 0

H1: b1 <> 0

is the F test

F* = MSR/MSE

If b1 = 0, E{F*} = s2/s2

= 1.

If b1<> 0, E{F*} > 1.

Thus the larger F*, the more likely that b1

<>

0.

It can be shown that if H0 holds (i.e., if b1=0)

F* = MSR/MSE ~ (c2(1)/1

) / (c2(n-2)/(n-2)) = F(1; n-2)

(ALSM5e p. 70; ALSM4e pp. 76-77)

3. Carrying Out the F Test

Example: Carry out the F test for the regression of % clerks on seasonality.

Choose a = .05.

Using the P-value method, calculate F* as

F* = MSR/MSE = (82.199)/(4.423) = 18.583

The P-value is P{F(1;7) > 18.583} = 0.004.

Since P-value = 0.004 < .05 = a, conclude

H1: b1 <> 0.

Using the decision theory method, the decision rule is

if F* <= F(1-a ; 1, n-2), conclude

H0

if F* > F(1-a ; 1, n-2), conclude H1

F(1-a ; 1, n-2) = F(0.95;1,7) = 5.59.

Since F* = 18.583 > 5.59, conclude H1: b1

<> 0 by this method also.

The principle of the decision theory method is shown in the next exhibit.

4. Equivalence of t Test and F Test

In the simple linear regression model, F* = (t*)2.

Example: In the regression of % clerks on seasonality, the squared

t-ratio for b1 is equal to F*, i.e.

(t*)2 = (-4.311)2 = 18.583 = F*

This is no longer true in the multiple regression model.

6. Maximum Likelihood Estimation

When the functional form of the probability distribution of ei

is specified (as in this case, where it is assumed normal), one can estimate

the parameters b0

, b1

and s2

by the maximum likelihood (ML) method. In essence, the ML

method "chooses as estimates those values of the parameters that are most

consistent with the sample data" (ALSM4e p. 30).

1. ML Estimation of the Mean m

Assume Y normally distributed and variance known (s

= 10); estimate mean m from sample with n =

3 (Y1 = 250, Y2 = 265, Y3 = 259).

Given an estimate of m, the likelihood L

of the sample (Y1, Y2, Y3) is the product

of the probability densities of the Yi given the value of the

estimated mean.

The normal probability density function is f(Y) = (1/(SQRT(2p)s))

exp(-(1/2)((Y- m)/s)2)

(ALSM4e Appendix A, Theorem A.34).

Example:

If m = 230, then f(Y1)

= 0.053991, f(Y2) = 0.000873, f(Y3) = 0.005953

so that

L (m = 230) = (0.053991)(0.000873)(0.005953)

= (.279)10-6

Similarly, if m = 259, then

L (m = 259) = (0.333225)(0.398942)(0.266085)

= 0.035373

Thus, the likelihood that m = 259 is greater

than the likelihood of m = 230.

(NOTE: Figures for the densities in NKNW p. 31 are incorrect;

they are all shifted 1 decimal place to the right.)

Graphically the situation is as in the next exhibit:

One could calculate the likelihood of the sample over a range of closely-spaced

values of m and graph the resulting likelihood

function of m. as in the following

exhibit:

The value of m corresponding to the maximum

of the likelihood function (here m = 258) is

the ML estimate of m. In practice

the value(s) of the parameter(s) that maximize the likelihood function

are found by iterative numerical optimization methods.

2. ML Estimation of the Normal Regression

Model

The principle for ML estimation of regression model is the same as for

m.

The likelihood function is as shown in NKNW Equation 1.26 p. 34.

The ML estimates of are the values that maximize this likelihood

function.

For teh simple regression model they are:

|

Parameter

|

ML Estimator

|

Remark

|

|

b0

|

^b0 = b0

|

same as OLS

|

|

b1

|

^b1 = b1

|

same as OLS

|

|

s2

|

^s2

= SSE/n

|

<> OLS (MSE = SSE/(n-2))

|

NOTE: maximum likelihood derivations often use the logarithm (base e)

of L rather than L itself. See NKNW Equation 1.29 p. 35.

7. Statistical Inference in Practice

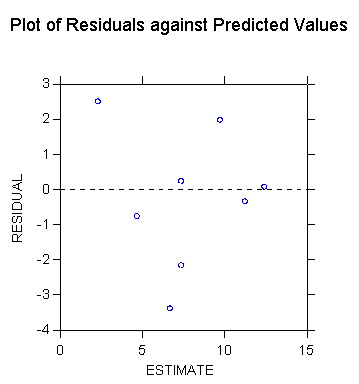

1. SYSTAT Commands for Simple Regression

The following printout shows how to obtain the simple regression of % clerks

on seasonality, plot the corresponding scatterplot with the estimated regression

line and the 95% Working-Hotelling confidence band, and how to get s{^Yh}

for Xh = 35 (a value of seasonality that does not correspond

to any case in the data set) by adding a dummy case with SEASON = 35 and

missing value for CLERKS.

>USE "Z:\mydocs\S208\craft.syd"

SYSTAT Rectangular file

Z:\mydocs\S208\craft.syd,

created Thu Nov 07,

2002 at 08:24:57, contains variables:

TYPE$

SIZE SEASON

CLERKS

>regress

>rem can also use

command MGLH instead of REGRESS

>model clerks=constant+season

>estimate

Dep Var: CLERKS

N: 9 Multiple R: 0.852 Squared multiple R: 0.726

Adjusted squared multiple

R: 0.687 Standard error of estimate: 2.103

Effect

Coefficient Std Error Std Coef

Tolerance t P(2 Tail)

CONSTANT

14.631 1.700

0.000 .

8.607 0.000

SEASON

-0.169 0.039

-0.852 1.000 -4.311

0.004

Analysis of Variance

Source

Sum-of-Squares df Mean-Square

F-ratio P

Regression

82.199 1 82.199

18.583 0.004

Residual

30.963 7

4.423

-------------------------------------------------------------------------------

Durbin-Watson D Statistic

1.995

First Order Autocorrelation

-0.107

>rem show a scatterplot

with the regression line

>rem and the Working-Hotelling

95% confidence band

>plot clerks*season/stick=out

smooth=linear short confi=0.95

>rem now add a case

with Xh=35, missing Y, using menus

>rem redo the estimation

and save residuals to get SEPRED

>model clerks=constant+season

>save clerkres

>estimate

1 case(s) deleted due

to missing data.

<...repeat output

deleted...>

Residuals have been saved.

>use clerkres

SYSTAT Rectangular file

Z:\mydocs\s208\clerkres.SYD,

created Fri Nov 15,

2002 at 10:20:07, contains variables:

ESTIMATE

RESIDUAL LEVERAGE COOK

STUDENT SEPRED

>list estimate residual

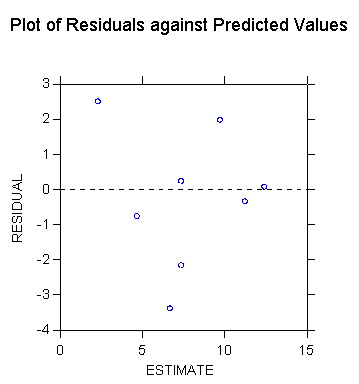

sepred

Case number

ESTIMATE RESIDUAL

SEPRED

1 2.311

2.489 1.485

2 7.374

0.226 0.714

3 9.737

1.963 0.814

4 6.699

-3.399 0.759

5 7.374

-2.174 0.714

6 9.737

1.963 0.814

7 11.256

-0.356 1.038

8 12.437

0.063 1.254

9 4.674

-0.774 1.035

10 8.724

. 0.723

>rem SEPRED = 0.723

for SEASON=35 is same as calculated by hand earlier

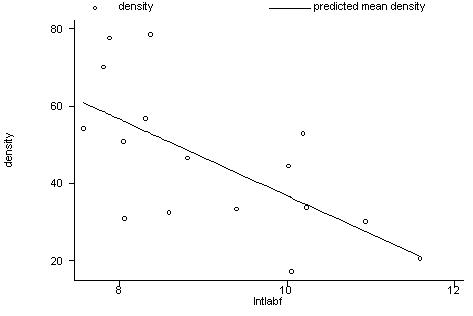

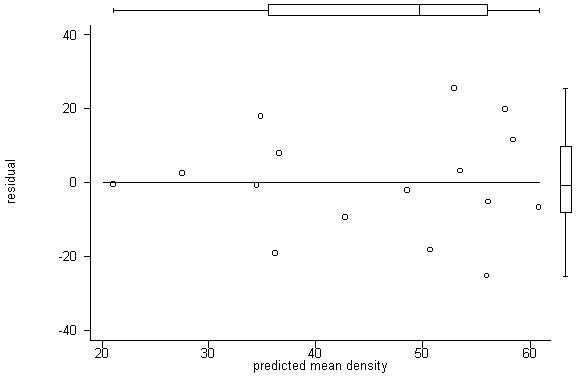

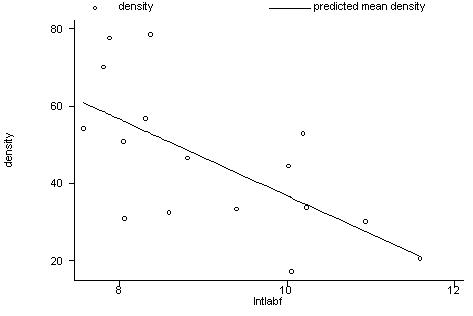

2. STATA Commands

. reg density lntlabf

Source |

SS df

MS

Number of obs = 16

---------+------------------------------

F( 1, 14) = 10.28

Model |

2260.31012 1 2260.31012

Prob > F = 0.0063

Residual | 3078.52104

14 219.89436

R-squared = 0.4234

---------+------------------------------

Adj R-squared = 0.3822

Total |

5338.83116 15 355.922077

Root MSE = 14.829

------------------------------------------------------------------------------

density |

Coef. Std. Err. t

P>|t| [95% Conf. Interval]

---------+--------------------------------------------------------------------

lntlabf |

-9.889076 3.084457 -3.206

0.006 -16.50458 -3.273573

_cons |

135.7141 28.3748 4.783

0.000 74.85625

196.572

------------------------------------------------------------------------------

. predict yhat

[option xb assumed;

fitted values]

. label variable

yhat "predicted mean density"

. predict e, resid

. label variable

e "residual"

. generate yhat0=_b[_cons]

+ _b[lntlabf]*lntlabf

. generate e0=density-yhat0

. predict new, stdp

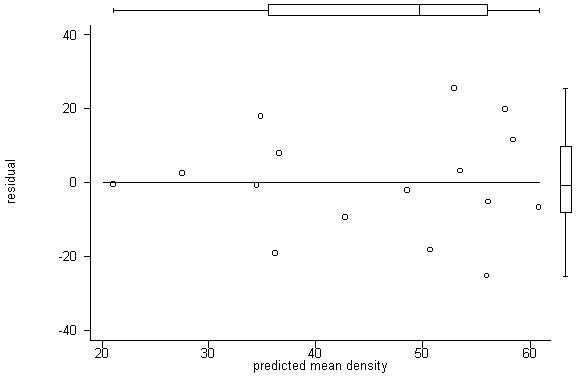

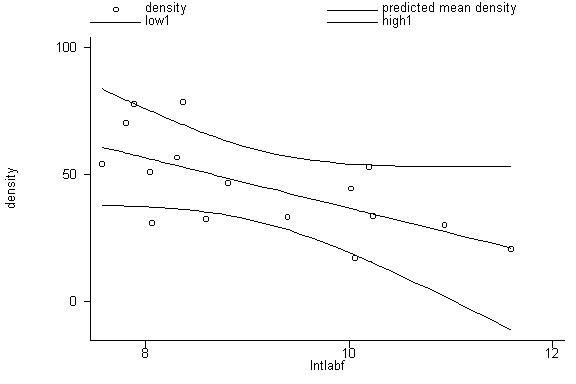

. graph density yhat

lntlabf, connect(.s) symbol (Oi) ylabel xlabel

. graph e yhat, twoway

box yline(0) ylabel xlabel

. display invttail(14,.025)

2.1447867

[If you’d rather use

the F-value here, use the command invFtail (dfn,dfd, p)]

. generate low1=yhat-2.1448*new

. generate high1=yhat+2.1448*new

. graph density yhat

low1 high1 lntlabf, connect(.sss) symbol(Oiii) ylabel xlabel

10. Historical Note

1. The Normal Distribution

The discoveries of the normal probability distribution and of the central

limit theorem are associated with mathematicians Pierre Simon Laplace and

Carl Friedrich Gauss.

Q - What languages are Laplace and Gauss using in these excerpts?

Why?

2. The Student t Distribution

The Student t distribution was discovered by William Gosset.

Q - Do you know the origin of the name "Student"?

Last modified Jan 2006